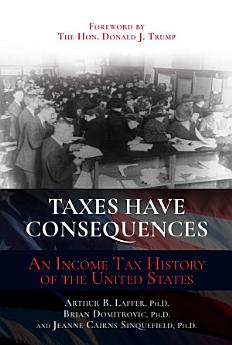

Taxes Have Consequences: An Income Tax History of the United States

Sep 2022 · Simon and Schuster

Ebook

440

Pages

family_home

Eligible

info

reportRatings and reviews aren’t verified Learn More

About this ebook

The definitive history of the effect of the income tax on the economy.

Ever since 1913, when the United States first imposed the income tax via constitutional amendment, the top rate of that tax has determined the fate of the American economy. When the top rate has been high, as in the late 1910s, the 1930s, 1940s, 1950s, and 1970s, the response of those with money and capital has been to curtail real economic activity in favor of protecting assets and income streams. Huge declines have come to the economy in these circumstances. The most brutal example was the Great Depression itself. When the top tax rate has been cut and held at reduced levels—as in the 1920s, the 1960s, in the long boom of the 1980s and 1990s, and briefly in the late 2010s—astonishing reversals have occurred. The rich have brought their money out of hiding and put it to work in the economy. The huge swings in the American economy since 1913 have had an inverse relationship to income tax rates.

Ever since 1913, when the United States first imposed the income tax via constitutional amendment, the top rate of that tax has determined the fate of the American economy. When the top rate has been high, as in the late 1910s, the 1930s, 1940s, 1950s, and 1970s, the response of those with money and capital has been to curtail real economic activity in favor of protecting assets and income streams. Huge declines have come to the economy in these circumstances. The most brutal example was the Great Depression itself. When the top tax rate has been cut and held at reduced levels—as in the 1920s, the 1960s, in the long boom of the 1980s and 1990s, and briefly in the late 2010s—astonishing reversals have occurred. The rich have brought their money out of hiding and put it to work in the economy. The huge swings in the American economy since 1913 have had an inverse relationship to income tax rates.

About the author

Arthur B. Laffer is the legendary founder of supply-side economics and economic advisor to President Ronald Reagan and Prime Minister Margaret Thatcher. He was awarded the Presidential Medal of Freedom by President Donald Trump in 2019.

Jeanne Cairns Sinquefield helped pioneer index-fund investing as executive vice president and head of trading at Dimensional Fund Advisors.

Brian Domitrovic is the author of five books, including the landmark history of supply-side economics Econoclasts.

Jeanne Cairns Sinquefield helped pioneer index-fund investing as executive vice president and head of trading at Dimensional Fund Advisors.

Brian Domitrovic is the author of five books, including the landmark history of supply-side economics Econoclasts.

Rate this ebook

Tell us what you think.

Reading information

Smartphones and tablets

Install the Google Play Books app for Android and iPad/iPhone. It syncs automatically with your account and allows you to read online or offline wherever you are.

Laptops and computers

You can listen to audiobooks purchased on Google Play using your computer's web browser.

eReaders and other devices

To read on e-ink devices like Kobo eReaders, you'll need to download a file and transfer it to your device. Follow the detailed Help Center instructions to transfer the files to supported eReaders.